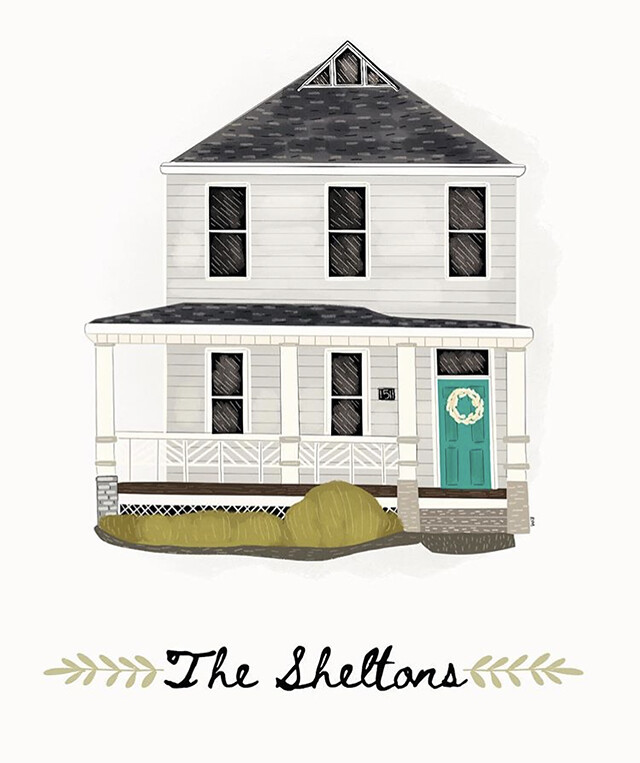

These are exciting days here in the Shelton household. This lovely place we've called home for the last 2 1/2 years (we've been renting) is officially ours! It's been a huge goal for us to buy a house for the last year or so, we just had to get ourselves in a position to do so. I get a lot of questions about our buying situation and why this is so big for us, so I thought I'd share more on our past ownership and how we got back here. I'll warn you though, if you're not interested in the backstory, feel free to skip the whole middle section. 😉

Johnny and I bought a home together a year after we were first married. It was definitely a "starter home" that we spent way more years owning than we had originally planned. At this time in our home-owning lives, Johnny worked as worship leader at our church and helped run our youth center (it was pretty cool), and I was a preschool teacher/turned stay-at-home-mom/turned blogger and Skunkboy Creatures handstitching extraordinaire. We weren't flush with cash, but we were mostly getting by and making our life together work, all while still chasing some sort of dream... well, more me than Johnny, but that's a deeper conversation.

As my Skunkboy Creatures dream was gaining traction and keeping me extremely busy, our church ended up going through a split and there wasn't enough money left to support Johnny's position. We were pretty tight on the monies as it was, so losing his job and stability was devastating for us. All around the same time this was happening, I was VERY pregnant and about to have Poesy. We made the decision to move out of our house and put renters in pretty soon after Poesy was born. Long story short (ish), the renters destroyed our house and we couldn't afford to get the house back up to a livable standard before the bank was going to take it. This is how we experienced our first (and hopefully ONLY) foreclosure. I was so embarrassed at the time and felt like such a failure. I had a partner and two children, but couldn't even afford to keep their safe space for living. It honestly took me several years to work through this. But again, that's a deeper conversation to be had.

After all of this sank in, we realized that there was nothing left for us in the town we had lived in for so many years. We actually knew this many years earlier, but after losing any anchor tying us there, it was time for us to find a community more appropriately suited for our young family. We decided that Springfield would be a good fit for us. We already had lots of friends here, since the norm at Lake of the Ozarks is to move away once you are college-age, and we knew the town pretty well since we would visit often. I found an adorable rental in a good neighborhood, and we made the plunge. I say "plunge" because Johnny was born and raised at the lake and I had lived there since I was in elementary school. A change of scenery was good. Very good. Life wasn't perfect, obviously, but we loved that house for 3 years until we found ourselves moving into this beautiful, historic home where we still reside today.

Now, if you're here for the part of the story where we got back on our feet and fixed our credit enough to buy a house, here it is! I feel especially proud of us for striving hard enough to get our things in order to buy the house we really wanted before the owners were ready to sell.

The first thing we did was

SET OUR GOAL. We knew our timeline and what we had to make work, so mapping out how to get there was essential. (We are also NOT planners, so this was big for us. 😅) If you've gone through a foreclosure, there is a specific amount of years that have to pass before anyone is willing to approve a home loan. This was a key part of our specific timeline.

The next big thing was

SAVE MONEY. Obviously, this is easier said than done, but we skipped a lot of trips/house upgrades/etc just to keep that money in the bank. This one can be quite a balancing act when you're working extra hard. Feeling like you're doing the overtime but depriving yourself so much that you question

why can be tricky. If you're in this boat right now, first remind yourself of your dream and goals, and maybe buy yourself that extra latte if your tired brain needs it. Save the money, but also feed the mental sanity.

Something I didn't know about until I started talking with our lender was

CREDIT REPAIR. As you can imagine, Johnny and I didn't have good credit AT ALL when we started this journey. We were scared of credit cards because we didn't want to overspend, and we had a foreclosure on our records. I got hooked up with a reputable

credit law firm and they made a world of difference. The cost is a bit different for everyone, but we ended up spending less than $1,000 for the two of us combined and we have seen insane results. They even got our foreclosure removed on a couple of the reporting agencies! I highly recommend this if you're in a position to do so. (The link is to my specific credit law firm, so if you decide to look into them, be sure to ask for Jacquelyn!)

Going back to some of my past fears, my advice is to go ahead and

GET A CREDIT CARD. My credit repair contact was the first to push me in this direction, but if the goal here is to build credit, you've got to show that you can spend responsibly and pay on time. This how you build the credit. I mean, we all kind of know that, but as a person who overspent on credit cards in the past, this was a big step for me. My opinion was always that I didn't need credit cards when I could just pay for things on the spot. If you want to build credit, it's essential.

Another thing that really helped me was to

GET OBSESSIVE. Download Credit Karma or an app like it and watch your credit climb. It's a great way to stay motivated and feel proud of all your efforts. Honestly, I looked forward to paying my bills every month because I would get to see that number rise. It sounds dorky, but it was very satisfying.

Last but not least, if you're on a pretty tight deadline, it's okay to

HAVE A BACKUP PLAN. Even if you go through all the work, it isn't guaranteed that everything will work out as planned. You'd better believe that I spent the last several months scoping out different homes in our area, just incase we encountered an unforeseen hiccup. Thankfully we didn't, but it isn't admitting defeat if you have an auxiliary plan in place. You've gotta take care of yourself and your specific situation/circumstances. 😊

(illustration by

Rebecca Lynn Illustration)

Johnny and I closed on our house on July 26th and we're excited to A) own a home after all these years, and B) start planning the bigger projects you get to do when a home is YOURS!

If you're still waiting to get here, I am rooting for you! Sometimes the road can be a long one, but with hard work, it's possible! Whatever your current situation, don't wait to make your space feel like your own. We had especially great landlords that let us do a lot more than most would, but there are lots of ways to make a house feel like home... even if you're currently in limbo. 💛